Intersoft ERP: Formerly known as INTERAC ERP

Track and Optimize Equipment Costs with Intersoft ERP

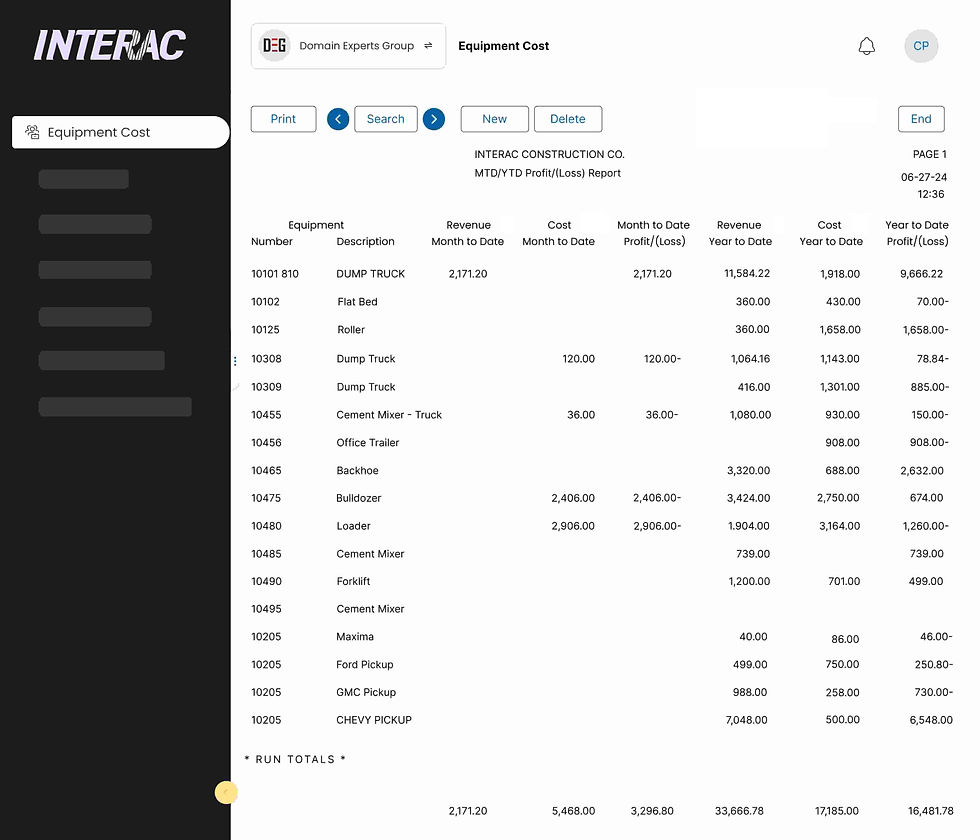

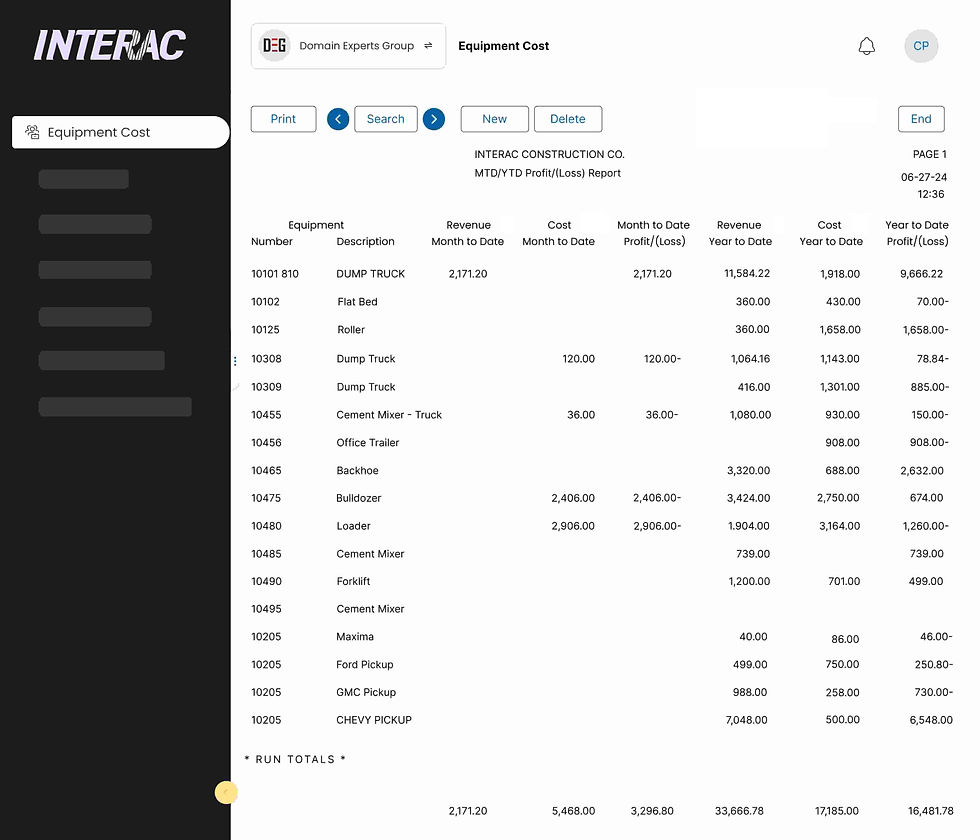

Intersoft ERP Equipment Cost module allows you to efficiently track, manage, and optimize all costs associated with your equipment, ensuring better budgeting, financial decision-making, and cost control.

The Problem:

Managing Equipment Costs Without Automation is Complex and Inefficient

Tracking and managing equipment costs manually or across disparate systems can lead to:

Difficulty tracking expenses related to equipment, including purchase costs, maintenance, repairs, and depreciation.

Inaccurate financial reporting, as equipment costs may not be recorded in real time.

Manual tracking of maintenance schedules, leading to missed or overdue maintenance and increased repair costs.

Ineffective budgeting, with inaccurate forecasts due to untracked or under-reported equipment expenses.

Compliance risks, as equipment-related regulatory requirements may be overlooked without proper tracking.

Key Features of Equipment Cost Management

Simplify Equipment Cost Tracking with These Key Features

Comprehensive Cost Tracking

Track all expenses related to equipment, including initial purchase cost, maintenance, repairs, fuel, and depreciation, to have a clear view of your total equipment expenses.

Depreciation Management

Automatically calculate and track depreciation for equipment over time, ensuring accurate financial records and insights into asset value changes.

Maintenance Scheduling

Set up automated maintenance schedules and reminders, ensuring timely upkeep of equipment and reducing unexpected repair costs or downtime.

Performance Monitoring

Track the performance and utilization of your equipment, helping you identify underperforming or overused assets to make informed decisions about repairs, replacements, or upgrades.

Cost Allocation

Allocate equipment costs across departments, projects, or cost centers for more accurate financial reporting and performance analysis.

Audit Trails & Compliance

Maintain an audit trail of all equipment-related activities, ensuring that your business is compliant with industry regulations and accounting standards.

Custom Reporting

Generate customizable reports on equipment costs, maintenance history, and performance, providing insights that aid in decision-making and cost optimization.

Cost Forecasting

Predict future equipment-related expenses, helping you budget effectively and plan for upcoming purchases, repairs, or replacements.

Integrated Asset Management

Integrate equipment cost tracking with your asset management module, ensuring a seamless workflow from acquisition to disposal.

How It Works

Step-by-Step Overview

Enter Equipment Details

Input your equipment information, including purchase price, maintenance history, and estimated useful life. Categorize equipment into relevant groups based on type, location, or department.

Track and Allocate Costs

Record and track all costs related to equipment, including purchase costs, repairs, and operating expenses, and allocate them to specific departments or projects for detailed financial insights.

Schedule and Monitor Maintenance

Set up maintenance schedules for each piece of equipment, automatically receiving reminders for upcoming service or inspections, minimizing downtime and repair costs.

Monitor Equipment Performance

Track usage and performance metrics for your equipment to identify and address issues before they lead to costly repairs or replacements.

Generate Reports

Generate detailed reports on equipment costs, maintenance schedules, and performance to help with budgeting, cost allocation, and strategic planning.

Benefits Overview

Why Choose Intersoft ERP’s Equipment Cost Management?

Comprehensive Visibility

Gain a 360-degree view of all equipment-related costs, helping you make informed financial decisions and optimize budget allocations.

Proactive Maintenance

Reduce unexpected breakdowns and downtime by automating maintenance schedules, ensuring equipment stays in good condition and performs at its best.

Cost Optimization

Track and control equipment costs by analyzing usage, performance, and cost allocation, helping you identify cost-saving opportunities and improve resource utilization.

Regulatory Compliance

Stay compliant with industry regulations by keeping accurate records of equipment purchases, maintenance activities, and audits.

Time Savings

Automate cost tracking, reporting, and maintenance scheduling, freeing up valuable time for other critical tasks and improving overall operational efficiency.

Module Integrations

Seamlessly Integrate Equipment Cost Management with Other Intersoft ERP Modules

Connected Modules:

General Ledger

Automatically post equipment-related costs to the general ledger, ensuring accurate financial records and real-time updates.

Inventory & Procurement

Track equipment purchases and integrate them with your inventory and procurement workflows, streamlining asset management.

Fixed Assets

Link equipment cost management with fixed asset tracking to have a unified view of asset depreciation, maintenance, and financial records.

Accounts Payable

Automatically link equipment-related expenses to vendor invoices, ensuring timely payments and accurate accounting.

Project Management

Allocate equipment costs to specific projects, providing detailed insights into project expenses and profitability.

Use Cases by Industry

Equipment Cost Management for Every Industry

Retail

Track costs related to store fixtures, IT equipment, and point-of-sale systems, helping retailers manage expenses effectively.

Healthcare

Track the cost of medical equipment and ensure timely maintenance to minimize downtime and avoid expensive repairs or replacements.

Construction

Manage the cost of construction equipment, track maintenance schedules, and allocate equipment expenses to specific projects to optimize budgeting.

Manufacturing

Track the cost of machinery, factory equipment, and tools, ensuring that all equipment expenses are accurately allocated to production costs.

Transportation & Logistics

Monitor the costs associated with vehicle fleets, including maintenance, fuel, and depreciation.

Energy & Utilities

Track the cost of specialized equipment used in energy production or utilities, optimizing maintenance schedules and reducing operating costs.

-

FranchisesCentralize your operations across multiple franchise locations with INTERAC. Our system provides real-time visibility and empowers each branch with the tools they need for accounting, payroll, and inventory management. Improve consistency, monitor performance, and support scalable growth in your franchise business with a solution that integrates all your operational needs.

-

Food & HospitalityOptimize your restaurant, hotel, or food service operations with INTERAC. From managing perishable inventory to optimizing staff schedules and vendor procurement, our system helps you streamline day-to-day operations. Reduce waste, ensure food safety compliance, and enhance the guest experience with powerful ERP tools designed for the food industry.

-

Public AccountingGrow your accounting firm with INTERAC. Our solution supports client accounting, time tracking, and billing, making it easier to manage multiple books, streamline payroll processing, and generate comprehensive reports. Keep clients satisfied, optimize firm operations, and ensure efficiency with our all-in-one ERP for public accountants.

-

Construction & ContractorsDesigned specifically for contractors, INTERAC streamlines job cost tracking, subcontractor management, and project progress monitoring. Effectively handle the complexities of union and non-union payroll while staying on schedule, within budget, and fully compliant with industry regulations. Track project costs, manage subcontractors, and ensure timely project completion with comprehensive reporting tools.

-

HealthcareSimplify complex billing, patient services, staffing, and compliance management with INTERAC. Our ERP system is designed for healthcare providers, clinics, and medical facilities, helping you manage HR, accounting, payroll, and document management while keeping data secure and HIPAA-compliant. Streamline operations and improve healthcare services with an integrated ERP solution.

-

ManufacturingManage your production planning, inventory control, quality assurance, and accounting seamlessly with INTERAC. Our system helps manufacturers track bill of materials, monitor labor costs, optimize raw material use, and ensure on-time delivery to customers. Gain full visibility into the entire manufacturing process with our comprehensive ERP solution.

-

RetailWhether you're managing a single store or multiple locations, INTERAC offers complete inventory visibility, vendor management, and sales integration. Leverage tools for promotions, restocking, and customer loyalty to deliver a seamless retail experience. Enhance operational efficiency and boost sales with a powerful retail ERP system.

-

Equipment Cost ManagementTrack the direct and indirect costs of equipment use, including maintenance, fuel, downtime, and depreciation. With INTERAC, make informed decisions about repair versus replacement and ensure cost-efficient operations in the field.

-

HR Management SolutionsStreamline hiring, onboarding, and employee records with INTERAC's HR Manager. Manage certifications, performance reviews, and compliance documents while improving workforce management and HR team productivity—all within a centralized HR platform.

-

Remote Time Clock for Workforce ManagementEnable employees to clock in and out from remote locations with INTERAC's Remote Time Clock. Features include GPS tracking, facial recognition, and seamless integration into payroll and job costing systems for accurate time tracking.

-

Job Manager for Project TrackingManage your entire project workflow with INTERAC's Job Manager. From task scheduling and resource allocation to milestone tracking, integrate job costing and time tracking to get a complete view of project performance.

-

Customer Relationship Management (CRM)Centralize customer data with INTERAC's CRM to enhance engagement at every touchpoint. Easily manage contacts, sales pipelines, service history, and follow-up actions. Perfect for sales teams, customer service departments, and account managers seeking greater visibility into customer relationships.

-

Document Management SystemOrganize and store critical business documents with INTERAC's Document Manager. From contracts to invoices, securely access, track versions, and quickly retrieve documents across departments. Improve document control and ensure secure, compliant access with a centralized system.

-

Report Manager for Custom ReportsCreate dynamic, real-time reports across finance, operations, and HR with INTERAC's Report Manager. Use built-in templates or design custom reports for stakeholders and regulatory bodies, ensuring compliance and informed decision-making.

-

Job Stream for Workflow AutomationStreamline repetitive project tasks with INTERAC's Job Stream. Automate communications, approvals, and updates to keep teams aligned and ensure projects stay on schedule.

-

Job Cost TrackingTrack labor, materials, equipment, and subcontractor costs in real-time with INTERAC's Job Cost module. Compare actual vs. estimated costs, monitor profitability, and make timely adjustments to stay within budget on projects.

-

Bank Reconciliation Made EasySimplify bank reconciliation by automatically matching bank transactions with your ERP records. INTERAC reduces reconciliation time, highlights discrepancies instantly, and ensures audit-ready accuracy. This solution supports multiple accounts and banking institutions, streamlining month-end processes.

-

Cash Management for Financial HealthMake informed decisions about your cash flow with INTERAC's Cash Manager. Forecast cash inflows/outflows, monitor balances across multiple accounts, and proactively manage your business’s financial health. Real-time dashboards provide key metrics to help optimize liquidity and cash flow management.

-

Equipment Lifecycle ManagementEfficiently manage the full lifecycle of each piece of equipment, from acquisition and deployment to servicing and retirement. Schedule preventive maintenance, log service history, and improve asset uptime with INTERAC's Equipment Manager, maximizing the efficiency of your equipment investments.

-

Time & Billing for Professional ServicesLog hours, assign them to specific projects or clients, and automate invoicing with INTERAC's Time & Billing module. Ideal for professional services, legal, and accounting firms, this module helps track time and optimize invoicing for maximum profitability.

-

Bill Manager for Efficient InvoicingTake full control of your invoicing and approval workflows with INTERAC's Bill Manager. This tool offers multi-level approvals, real-time tracking, and paperless workflows, ensuring accuracy and compliance. Attach supporting documents, monitor due dates, and gain complete visibility into your accounts payable pipeline.

-

Interlink (Import & Export) IntegrationEasily exchange data between INTERAC and third-party software or spreadsheets with Interlink. Save time on data re-entry, reduce errors, and ensure secure, customizable import/export templates for seamless data integration.

-

Loan Amortization ManagementGenerate detailed loan schedules and calculate interest/principal splits with INTERAC's Loan Amortization module. Easily integrate loan data with your general ledger, and manage business loans, leases, or internal financing arrangements.

-

Accounts Receivable (AR) ManagementEnhance your collections process and gain better cash flow visibility with INTERAC's Accounts Receivable system. Effortlessly track invoices, manage credit limits, generate statements, and automate payment reminders. Real-time updates enable quick responses to customer inquiries and ensure accurate payment application.

-

General Ledger IntegrationYour financial backbone, INTERAC's General Ledger module provides real-time financial postings across all integrated modules. Generate trial balances, income statements, and balance sheets with drill-down capabilities, customizable account structures, and a comprehensive view of your financial data.

-

Subcontractor ControlEfficiently track subcontractor agreements, insurance, lien waivers, and payments with INTERAC's Subcontractor Control module. Maintain compliance, stay on schedule, and ensure budget adherence for your projects.

-

Order Processing AutomationSpeed up your order-to-cash cycle with INTERAC's Order Processing system. Automate sales orders, check inventory in real-time, generate pick tickets and invoices, and track orders from placement to delivery for improved operational efficiency.

-

Service Billing for Accurate InvoicingGenerate accurate, timely invoices for service-based work with INTERAC's Service Billing module. Track billable hours, materials, and recurring service contracts to optimize revenue streams and improve billing efficiency.

-

Payroll Solutions for ComplianceManage payroll processing efficiently with INTERAC's Payroll Solutions. Handle calculations, deductions, taxes, garnishments, and direct deposits with ease, ensuring compliance with federal and state regulations. Generate W-2s/1099s and other required payroll reports with automated tools.

-

Depreciation Management for Fixed AssetsEnsure fixed asset compliance with automated depreciation management. INTERAC supports multiple depreciation methods (MACRS, straight-line, etc.), helping you generate accurate reports for audits, taxes, and internal financial planning. Simplify asset tracking and depreciation calculations while staying compliant with industry regulations.

-

Inventory Management SystemGain 360-degree visibility into your inventory with INTERAC's Inventory Manager. Track real-time stock levels, manage reorder points, automate restocking, and prevent stockouts or overstocking. Integrated barcode scanning and location management enhance efficiency.

-

Accounts Payable (AP) SolutionsAutomate your accounts payable process to eliminate manual data entry, avoid duplicate payments, and strengthen vendor relationships. INTERAC's AP module streamlines digital invoice capture, customizable approval workflows, and integration with your general ledger for accurate financial tracking. Built-in reporting features provide real-time insights into cash flow, payment schedules, and outstanding liabilities.

-

Client Accounting for Service ProvidersIdeal for accounting firms and service providers, INTERAC's Client Accounting module allows you to manage separate books, payrolls, and reports for each client while maintaining centralized control. Automate recurring entries, billable time, and generate custom financial reports to streamline your operations.

-

Payroll Data Entry AutomationSimplify high-volume payroll data entry with INTERAC's Payroll Data Entry module. Designed for organizations with separate time entry systems, this tool ensures data accuracy, reducing manual processing time and improving payroll efficiency.

-

Purchase Order ManagementControl spending with INTERAC's Purchase Order module. Manage vendor purchases with multi-level approval workflows, track received goods, link to accounts payable, and maintain accurate audit trails for complete purchase order management.

-

Fixed Asset Management SolutionsManage the complete asset lifecycle with INTERAC's Fixed Asset Management module. Track asset acquisitions, automate depreciation, and integrate seamlessly with your general ledger for accurate financial reporting. Stay compliant, reduce downtime, and maximize asset value—all from a user-friendly platform.

-

Can Intersoft ERP handle purchase orders and vendor management?Yes, Intersoft ERP automates the creation of purchase orders, tracks vendor deliveries, and helps maintain optimal stock levels, ensuring timely restocking and efficient vendor management.

-

Can I manage both online and in-store sales with Intersoft ERP?Yes, Intersoft ERP allows you to manage sales from both in-store and online channels in one system, ensuring consistent pricing, inventory, and promotions across all sales platforms.

-

How does Intersoft ERP improve customer relationships?The CRM module in Intersoft ERP centralizes customer data, allowing you to track purchase history, preferences, and engagement, enabling personalized marketing and improved customer loyalty.

-

Can Intersoft ERP integrate with my existing POS system?Yes, Intersoft ERP seamlessly integrates with your point of sale systems, allowing for real-time sales tracking, inventory updates, and streamlined reporting.

-

How does Intersoft ERP help optimize profitability for retail businesses?With features like real-time sales reporting, cost tracking, and inventory optimization, Intersoft ERP helps you manage margins, optimize pricing strategies, and make smarter business decisions.

-

How does Intersoft ERP support tax compliance for public accounting firms?Intersoft ERP automatically calculates taxes based on current tax regulations, helps prepare tax filings, and ensures your clients remain compliant with federal, state, and local laws.

-

Is Intersoft ERP suitable for small and large accounting firms?Yes, Intersoft ERP is scalable, making it ideal for both small boutique firms and larger public accounting practices that need robust, secure financial management tools.

-

Can Intersoft ERP help with audit preparation?Yes, Intersoft ERP keeps a complete, traceable record of all financial transactions, ensuring you’re always audit-ready with clear audit trails and easy document retrieval.

-

How does Intersoft ERP handle financial reporting for public accountants?Intersoft ERP enables you to generate real-time, customizable financial reports for clients, such as balance sheets, income statements, and cash flow statements, ensuring accuracy and timely delivery.

-

What are the benefits of using an integrated accounting system like Intersoft ERP?Integration eliminates data silos, ensuring that all client financial data is connected, up-to-date, and accessible across all modules, improving accuracy and workflow efficiency.

-

How does Intersoft ERP help with production planning?Intersoft ERP offers automated scheduling, real-time tracking, and resource allocation tools to ensure your production plans are optimized and executed smoothly.

-

Can Intersoft ERP integrate with my existing manufacturing equipment or IoT devices?Yes, Intersoft ERP can integrate with IoT devices, machinery, and automated production systems to collect real-time data and improve workflow efficiency.

-

Does Intersoft ERP support multi-site manufacturing operations?Yes, Intersoft ERP can manage operations across multiple manufacturing sites, offering centralized control and local visibility for production, inventory, and financials.

-

How can Intersoft ERP help reduce manufacturing costs?By providing insights into production inefficiencies, material waste, and labor costs, Intersoft ERP helps you identify and eliminate unnecessary expenses.

-

How does Intersoft ERP handle regulatory compliance for manufacturers?Intersoft ERP generates compliance reports, tracks necessary certifications, and ensures all manufacturing processes adhere to industry regulations and standards.

-

How does Intersoft ERP handle patient billing and insurance claims?Intersoft ERP automates patient billing, generates accurate invoices, tracks insurance claims, and streamlines follow-up processes to ensure timely reimbursement.

-

What types of healthcare providers can benefit from Intersoft ERP?Intersoft ERP is ideal for clinics, hospitals, private practices, long-term care facilities, pharmaceutical companies, and medical supply providers, offering tools to manage billing, payroll, compliance, and operations.

-

Can Intersoft ERP integrate with existing healthcare systems?Yes, Intersoft ERP can integrate with other healthcare management software, ensuring smooth data flow and minimizing disruptions during implementation.

-

Can I manage multiple healthcare facilities with Intersoft ERP?Yes, Intersoft ERP allows healthcare providers to manage multiple locations from a single platform, consolidating data for improved oversight and reporting.

-

How does Intersoft ERP support HIPAA compliance?Intersoft ERP offers secure, encrypted storage and management of patient data, with features designed to ensure full compliance with HIPAA regulations.

-

Can I customize processes for individual franchise locations?Yes, Intersoft ERP allows you to tailor operations, such as payroll, inventory management, and reporting, to suit the needs of individual franchisees while maintaining centralized oversight.

-

How does Intersoft ERP help manage multi-location franchises?Intersoft ERP offers a centralized dashboard that tracks all franchise locations’ sales, inventory, and financial data, ensuring real-time visibility and control across your entire network.

-

What industries can benefit from Intersoft ERP for franchises?Intersoft ERP is ideal for franchises in food and beverage, retail, services, and health & wellness industries, streamlining operations, improving consistency, and driving growth across all locations.

-

Can Intersoft ERP help with financial consolidation?Absolutely. Intersoft ERP consolidates financial data from all locations into real-time reports, giving franchise owners a clear overview of their network’s performance and financial health.

-

Does Intersoft ERP ensure franchise compliance?Yes, Intersoft ERP tracks compliance with franchise agreements, local regulations, and operational standards, helping you stay aligned and avoid potential violations.

-

Can Intersoft ERP manage payroll for restaurant and hotel staff?Yes, Intersoft ERP automates payroll for both front and back-end staff, ensuring compliance with labor laws and accurate, on-time payments.

-

How can Intersoft ERP help food and hospitality businesses manage inventory?Intersoft ERP allows you to track inventory levels in real-time, set automatic reorder points, and prevent waste by ensuring you only order what you need.

-

Can Intersoft ERP be used across multiple locations?Yes, Intersoft ERP supports multi-location management, allowing you to track inventory, labor, and sales across various restaurants or hotels from a single platform.

-

How does Intersoft ERP support food safety compliance?The system tracks expiration dates, certifications, and safety inspections, helping you stay compliant with local regulations and avoid costly violations.

-

What type of financial reports can Intersoft ERP generate?Intersoft ERP generates real-time financial reports, including profit and loss statements, budget tracking, and cost analysis, to ensure your business stays on track financially.

-

How does Intersoft ERP support subcontractor management?The system centralizes subcontractor agreements, insurance details, and payment schedules, ensuring all documentation is in place for compliance and timely payments.

-

Is Intersoft ERP suitable for small contractors and large construction firms?Yes, Intersoft ERP scales to fit both small contractors managing a few jobs and large firms overseeing multiple projects simultaneously, providing flexibility and control.

-

What type of reporting does Intersoft ERP offer for construction projects?Intersoft ERP provides real-time reports on project costs, timelines, and progress, allowing businesses to make data-driven decisions and adjustments as needed.

-

Can Intersoft ERP manage payroll for union and non-union workers?Yes, the system handles both union and non-union payroll, ensuring compliance with regulations and accurate payment processing.

-

How can Intersoft ERP help construction businesses manage job costs?Intersoft ERP tracks job costs in real-time, giving businesses insights into labor, material, and equipment expenses. This helps prevent budget overruns and ensures projects stay on track.

-

How does Time & Billing support client transparency and communication?Time & Billing enhances client transparency by providing detailed, easy-to-read invoices that break down hours worked, project phases, and costs. Additionally, clients can access real-time updates on the status of their projects, increasing trust and satisfaction.

-

What is Time & Billing in an ERP system?Time & Billing in an ERP system helps businesses track employee work hours, manage client billing rates, and generate invoices for services rendered. It streamlines the process of recording time spent on projects, calculating charges, and ensuring accurate billing for clients.

-

How does Time & Billing help with compliance and audit readiness?Time & Billing helps businesses stay compliant with industry regulations by tracking billable hours, overtime, and project details in a structured, auditable manner. This ensures that all records are available for review during audits and that the business remains transparent with clients and authorities.

-

Can Time & Billing automate recurring billing?Yes, Time & Billing can automate recurring billing for retainer agreements, subscription services, or ongoing projects. This eliminates the need for manual invoicing each billing cycle, improving efficiency and ensuring consistency in cash flow.

-

How does Time & Billing help with invoicing accuracy?Time & Billing reduces the risk of invoicing errors by automating time tracking and directly integrating this data with billing systems. This ensures accurate client invoices, minimizes human errors, and accelerates the billing process.

-

How can Time & Billing help with employee productivity tracking?Time & Billing enables businesses to track employee work hours on specific tasks and projects. This data can be analyzed to assess productivity, identify areas for improvement, and allocate resources more effectively, improving overall operational efficiency.

-

How can Time & Billing improve project profitability?Time & Billing enables businesses to track billable hours accurately and ensures that clients are billed appropriately based on actual time worked. By automating time tracking and invoice generation, businesses can avoid underbilling and maximize profitability on each project.

-

How does Time & Billing integrate with other ERP modules?Time & Billing integrates seamlessly with other modules like project management, payroll, accounts receivable, and financial reporting. This integration ensures that time records are accurately reflected in financial data and billing, streamlining operations across the business.

-

How does Time & Billing improve cash flow management?By automating time tracking and invoice generation, Time & Billing accelerates the billing cycle, leading to faster payments and improved cash flow management. With real-time visibility into outstanding invoices and project progress, businesses can proactively follow up on overdue payments.

-

Can Time & Billing handle different billing models?Yes, Time & Billing supports various billing models, including hourly billing, flat-rate pricing, retainer agreements, and milestone-based billing. This flexibility allows businesses to choose the model that best suits their client agreements and project types.

-

How does Subcontractor Control enhance project visibility?Subcontractor Control provides real-time updates on subcontractor progress, availability, and tasks. With centralized data and reporting, project managers can easily monitor subcontractor performance, identify bottlenecks, and adjust project timelines or resources to maintain efficiency.

-

Can Subcontractor Control improve subcontractor communication?Yes, Subcontractor Control enables seamless communication by allowing you to track subcontractor communications within the ERP system. This helps prevent misunderstandings, ensures that expectations are clearly outlined, and maintains a record of all project-related discussions.

-

Can Subcontractor Control help with compliance and regulatory requirements?Yes, Subcontractor Control ensures compliance by tracking subcontractor certifications, licenses, and insurance requirements. It can also provide reminders for expiring documents or certifications, helping your business stay compliant with industry regulations.

-

How does Subcontractor Control support payment management?Subcontractor Control automates the payment process for subcontractors, ensuring they are paid promptly according to the contract terms. It tracks payment milestones, retainage, and invoicing, reducing administrative overhead and minimizing errors in subcontractor payments.

-

Can Subcontractor Control integrate with other ERP modules?Yes, Subcontractor Control integrates seamlessly with other ERP modules like procurement, job costing, inventory management, and accounts payable. This ensures that subcontractor costs are tracked accurately and invoicing is linked to the correct project expenses.

-

What is Subcontractor Control in an ERP system?Subcontractor Control in an ERP system helps businesses manage and track subcontractors working on various projects. It allows for the efficient onboarding, assignment, and monitoring of subcontractors while ensuring accurate billing, compliance, and reporting, all integrated within the broader project management framework.

-

How does Subcontractor Control help with document management?Subcontractor Control streamlines document management by storing and managing essential subcontractor-related documents like contracts, certifications, and insurance papers. These documents are securely stored within the ERP system, making them easily accessible for review or audit purposes.

-

How does Subcontractor Control streamline project management?Subcontractor Control ensures smooth collaboration by managing subcontractors’ schedules, deliverables, and payments. By integrating with project management and financial modules, businesses can keep track of subcontractor progress, ensure projects stay on schedule, and maintain accurate costs.

-

How can Subcontractor Control improve cost tracking and budgeting?With Subcontractor Control, businesses can track subcontractor expenses in real time. The system integrates with job costing and procurement modules, providing insights into subcontractor costs, ensuring that projects remain within budget and any cost overruns are identified early.

-

How can Subcontractor Control help with subcontractor performance tracking?Subcontractor Control enables businesses to track and evaluate subcontractor performance based on key metrics like deadlines, quality of work, and budget adherence. This data can help make informed decisions about future subcontractor partnerships and manage risks more effectively.

-

Can I track the status of service invoices with Service Billing software?Yes, Service Billing software allows you to track the status of invoices in real time. You can view whether an invoice is paid, pending, or overdue, and send automatic reminders to clients, streamlining the payment collection process and ensuring timely cash flow.

-

Can Managed Services Billing Software integrate with other ERP modules?Yes, Billing software for professional services integrates with other ERP modules like accounts receivable, project management, and time tracking. This integration ensures that all billable services are captured correctly, improving invoice accuracy and making it easier to manage customer accounts.

-

How can billing software for professional services help manage service contracts?Billing software for professional services helps manage service contracts by tracking service terms, billing schedules, and payment due dates. The ERP system can automatically generate invoices based on the contract terms, ensuring that clients are billed according to agreed-upon service levels.

-

How does billing software for professional services help with recurring billing?Billing software for professional services enables you to set up recurring billing for subscription-based or ongoing services. You can automate monthly or quarterly invoices, ensuring that customers are billed on time for ongoing services without the need for manual intervention.

-

How does Managed Services Billing Software improve billing accuracy?Billing software for professional services reduces errors by automating the billing process. By integrating with time tracking, project management, and client account data, it ensures that the charges are accurate, service details are correct, and no billable hours or services are missed, leading to fewer disputes and faster payments.

-

What is Managed Services Billing Software in an ERP system?Managed Services Billing Software in an ERP system refers to the process of billing customers for services rendered, rather than physical goods. The ERP module streamlines the creation of invoices for services, automates billing cycles, and integrates with other modules like accounts receivable and payroll to ensure accurate, timely billing.

-

What is the advantage of using Managed Services Billing Software for businesses in the USA?Managed Services Billing Software for businesses in the USA offers a comprehensive solution for automating invoicing, tracking service contracts, and managing recurring billing. This software ensures businesses in the USA can reduce billing errors, streamline their financial processes, and improve cash flow. With real-time tracking and accurate billing, companies can avoid costly mistakes and enhance operational efficiency, leading to faster payments and better financial management.

-

How can Service Billing Software help with tax management?The Service Billing Software can automatically apply the correct tax rates based on the location and type of service provided. This ensures compliance with local tax laws and reduces the chances of errors when calculating taxes on service charges.

-

How can Managed Services Billing Software improve cash flow management?With Service Billing in your ERP system, you can automate billing cycles and track overdue invoices. This ensures consistent cash flow by reducing delays in invoicing and improving the accuracy of billable hours or service charges, allowing your business to receive payments on time.

-

How does Service Billing Software support multi-currency billing?Service Billing Software in ERP systems supports multi-currency billing, allowing you to create invoices in the local currency of your clients, whether they are domestic or international. This feature helps streamline billing for global businesses and ensures accurate currency conversion for cross-border transactions.

-

Can I customize service billing rates for different clients?Absolutely. Billing software for professional services allows you to set customized billing rates for different clients or service types. You can adjust rates based on factors such as hourly work, fixed-price contracts, or service packages, ensuring you are billing customers fairly and accurately.

-

How does Report Manager help with compliance and audits?The Report Manager helps with compliance and audits by generating audit-ready reports that track key financial transactions, inventory movements, and other regulatory metrics. These reports can be stored securely, ensuring transparency and easy access during audits.

-

Can Report Manager support multi-location or multi-currency businesses?Yes, Report Manager can support multi-location and multi-currency businesses. It allows you to generate consolidated reports across different regions, departments, or currencies, making it ideal for businesses with a global or multi-site presence.

-

What types of reports can Report Manager generate?Report Manager can generate a wide variety of reports, including financial reports, sales reports, inventory reports, employee performance reports, vendor performance reports, profitability analysis, and cash flow statements. These reports can be customized and scheduled for automatic delivery.

-

Can I customize the reports in a Report Manager?Yes, Report Manager systems allow you to customize reports according to specific business needs. You can adjust filters, add or remove data points, and select the format (charts, tables, etc.) to ensure the reports provide exactly the information you need.

-

How can Report Manager help with financial reporting?The Report Manager generates comprehensive financial reports, including profit and loss statements, balance sheets, and cash flow reports. It ensures that financial data is up-to-date, accurate, and compliant with accounting standards, making it easier to manage budgets, forecast, and ensure regulatory compliance.

-

How does Report Manager improve reporting accuracy?By automating data collection and integrating with other ERP modules, Report Manager reduces human error, ensuring the accuracy of reports. It eliminates manual entry errors and outdated data, providing consistently accurate financial, operational, and inventory reports.

-

Can Report Manager generate real-time reports?Yes, Report Manager can generate real-time reports, offering instant insights into your business performance. This feature enables you to track daily, weekly, or monthly performance indicators, ensuring your business stays agile and responsive to any changes in operations.

-

What is a Report Manager in an ERP system?A Report Manager in an ERP system allows businesses to generate, manage, and analyze reports across various departments and functions. It centralizes the reporting process, offering tools to customize, automate, and distribute reports, helping business owners and managers make data-driven decisions.

-

Can Report Manager integrate with other modules in the ERP system?Yes, the Report Manager seamlessly integrates with other ERP modules like accounts payable, accounts receivable, inventory, and payroll. This integration allows you to create holistic, multi-dimensional reports that give you a complete view of your business operations.

-

How does Report Manager improve decision-making?The Report Manager streamlines the data collection process, providing real-time, accurate reports on finances, inventory, sales, and more. With easy access to key metrics, decision-makers can make informed, timely choices that drive business growth and improve operational efficiency.

-

Can the Time Tracker & Employee Timesheet Software Track Breaks and Overtime?Yes, time tracker & employee timesheet software can track employee breaks, overtime, and shifts, providing detailed data on work hours. It ensures compliance with labor laws by automatically calculating break times and overtime rates, minimizing the risk of payroll errors and penalties. This software simplifies the tracking process, making it easier to manage work hours accurately and efficiently.

-

How does a Employee Time Tracking Software integrate with payroll?The Employee Time Tracking Software integrates directly with the Payroll system within your ERP, ensuring accurate and seamless calculation of employee wages based on recorded hours. This automation eliminates manual entry errors and streamlines payroll processing.

-

What reporting features does the employee time tracking software offer?The Employee Time Tracking Software provides robust reporting features, including detailed reports on hours worked, employee attendance, overtime, and time-off requests. These reports can be customized and exported for analysis, helping businesses optimize workforce management and make informed decisions.

-

What is a Employee Time Tracking Software in an ERP system?Employee Time Tracking Software in an ERP system allows employees to clock in and out from any location using a mobile device, computer, or other digital tools. This functionality is ideal for businesses with remote teams or field workers, ensuring accurate time tracking and attendance management.

-

What is the benefit of using Employee Time Tracking Software for Businesses in the USA?Employee time tracking software for businesses in the USA allows companies to efficiently track employee work hours, whether they are in the office, working remotely, or on the go. This software eliminates the need for paper timesheets and manual entries, providing real-time, accurate data that ensures compliance with labor laws. It reduces administrative tasks, enhances payroll accuracy, and helps businesses save time while improving productivity. By adopting employee time tracking software, companies can streamline operations and focus on growing their business.

-

How does a best employee time tracking software improve employee accountability?The best employee time tracking software accountability by tracking work hours accurately, preventing time theft, buddy punching, and unapproved overtime. Employees can clock in/out using unique IDs or biometrics, ensuring the data is reliable and trustworthy.

-

How does the best employee time tracking software integrate with other business systems?The best employee time tracking software seamlessly integrates with other business systems within your ERP, such as payroll, human resources, project management, and employee scheduling. This integration streamlines time tracking, attendance, and reporting, ensuring consistency and efficiency across departments.

-

How Secure is the Data with Time Tracker & Employee Timesheet Software?Time tracker & employee timesheet software ensures data security by using advanced encryption and secure access protocols to protect sensitive employee information. With cloud-based solutions, data is stored securely and can only be accessed by authorized personnel, ensuring confidentiality and compliance with privacy regulations.

-

Can Employees Clock In and Out from Multiple Devices with Time Tracker & Employee Timesheet Software?Yes, with time tracker & employee timesheet software, employees can clock in and out from multiple devices such as mobile phones, tablets, laptops, or desktop computers. This flexibility ensures that remote workers, field employees, and those on-the-go can easily track their time, no matter where they are, making time management seamless across various locations.

-

Can the best employee time tracking software track multiple time zones?Yes, best employee time tracking software can handle employees working across multiple time zones, ensuring that work hours are recorded accurately for each employee regardless of their location. This feature is ideal for businesses with remote teams across different regions or countries.

-

How does the best employee time tracking software ensure compliance with labor laws?The best employee time tracking software is designed to comply with various labor laws and regulations, such as those concerning minimum wage, overtime, and breaks. It automatically records and reports employee work hours, ensuring accurate payroll and reducing the risk of legal issues.

-

How does a Purchase Order module streamline procurement?The Purchase Order module in an ERP system streamlines procurement by automating order creation, approval workflows, and vendor communication. It helps ensure timely order processing, reduces errors, and enhances supplier relationships by keeping all purchasing activities centralized.

-

How does the Purchase Order module support approval workflows?The Purchase Order module supports multi-level approval workflows, allowing businesses to set up a hierarchy of approvers before an order is finalized. This ensures that only authorized individuals approve purchases, improving control and compliance.

-

How does the Purchase Order module handle vendor communication?The Purchase Order module facilitates seamless vendor communication by automatically generating POs and sending them to suppliers. It can also track order status, send reminders, and maintain a history of all communications, helping ensure transparency and timely deliveries.

-

What is the role of Purchase Orders in budgeting and cost control?Purchase Orders play a critical role in budgeting and cost control by providing visibility into future spending. Businesses can track and compare actual expenses against the budget, identify cost overruns early, and ensure that procurement stays within financial limits.

-

What is a Purchase Order in an ERP system?A Purchase Order (PO) in an ERP system is a formal request from a business to a vendor to supply specific products or services at agreed-upon prices. It helps manage procurement processes by automating the creation, approval, and tracking of orders.

-

How does the Purchase Order module support reporting and analytics?The Purchase Order module provides robust reporting and analytics tools, allowing businesses to track outstanding orders, analyze purchasing trends, monitor supplier performance, and generate detailed reports. These insights help businesses make informed decisions and optimize their procurement strategies.

-

How does Purchase Order integration with inventory management work?The Purchase Order module integrates seamlessly with Inventory Management to automatically update stock levels when orders are placed. This integration ensures real-time visibility of inventory, preventing stockouts, overstocking, and inaccurate inventory reporting.

-

How does the Purchase Order module improve order accuracy?The Purchase Order module minimizes errors by auto-populating item details, pricing, and terms from previously negotiated contracts. Automated workflows ensure that POs are reviewed, approved, and submitted with accurate details, reducing the risk of mistakes in the procurement process.

-

Can Purchase Orders be customized in an ERP system?Yes, Purchase Orders in an ERP system can be customized to match your business’s needs. Custom fields, approval workflows, and reporting options can be tailored to reflect your procurement process and ensure compliance with internal policies.

-

Can Purchase Order functionality handle multiple suppliers?Yes, Purchase Order functionality in an ERP system supports multiple suppliers. It allows businesses to track orders from various vendors, manage different pricing agreements, and ensure accurate inventory levels across multiple supplier relationships.

-

Can Payroll Software Solutions handle employee benefits and deductions?Yes, Payroll Software Solutions can manage employee benefits and deductions, including healthcare, retirement plans, and tax withholdings. The system ensures that deductions are applied accurately and integrates with benefits management to keep employee records up to date.

-

How does Payroll Management System Software integrate with other modules in the ERP system?Payroll Management System Software integrate seamlessly with other ERP modules like General Ledger, Accounts Payable, and Time Tracking. This ensures smooth data flow, reducing manual entry, and ensuring accurate financial reporting and real-time insights into payroll expenses.

-

Why is the Best Payroll Management Software for Businesses in the USA crucial for companies?The Best Payroll Management Software for Businesses in the USA is essential because it automates complex payroll processes, ensuring accuracy and compliance with local regulations. By using this software, businesses can eliminate human errors, streamline tax reporting, and speed up payroll processing. It helps businesses save time, avoid costly mistakes, and ensure employees are paid correctly and on time, all while improving cash flow management.

-

What are the best Payroll Management Software in an ERP system?Best Payroll Management Software in an ERP system streamline the management of employee compensation. They automate payroll calculations, deductions, tax filings, and reporting, helping businesses ensure timely, accurate, and compliant payroll processing.

-

What reporting capabilities do Payroll Management Software offer?Payroll Management System Software in ERP systems provide comprehensive reporting capabilities, including real-time payroll reports, tax filings, employee earnings, deductions, and benefits. Customizable reports can be generated for auditing, compliance, and decision-making purposes, giving businesses full transparency into payroll data.

-

How do Payroll Management Software in an ERP system save time?Best Payroll Management Software in an ERP system automate routine tasks such as tax calculations, deductions, and benefit management. This reduces manual effort, minimizes human error, and speeds up the payroll process, saving businesses valuable time every payroll cycle.

-

How does Payroll Management System Software ensure tax compliance?Payroll Management System Software ensure compliance with tax regulations by automatically applying the latest federal, state, and local tax rates, as well as deductions and benefits. The system calculates payroll taxes and generates tax forms like W-2s and 1099s, minimizing the risk of penalties due to non-compliance.

-

How secure is Payroll Software Solutions in an ERP system?Payroll Software Solutions ensure data security through advanced encryption, multi-factor authentication, and role-based access controls. Sensitive payroll data, including employee compensation and tax details, is protected from unauthorized access, ensuring compliance with privacy regulations such as GDPR and CCPA.

-

Can Payroll Management System Software handle complex pay structures?Yes, Payroll Management System Software can manage complex pay structures such as salaried, hourly, commission-based, and contract employees. They accommodate varying pay rates, bonuses, overtime, and shift differentials, ensuring accurate calculations for all compensation types.

-

How does Payroll Software Solutions improve employee satisfaction?Payroll software Solutions improve employee satisfaction by ensuring accurate and timely payroll processing. With features such as self-service portals, employees can view payslips, track benefits, and request time off, providing transparency and reducing payroll-related concerns.

-

Can Payroll Management System Software support multiple payroll frequencies?Yes, Payroll Management System Software can handle multiple payroll frequencies, including weekly, bi-weekly, semi-monthly, and monthly payroll cycles. The system ensures employees are paid on time, regardless of the payroll frequency, and automates calculations for each payroll cycle.

-

Can Payroll Data Entry handle different employee compensation types?Yes, Payroll Data Entry can accommodate different compensation types, including salaried, hourly, contract, and commission-based employees. The system processes these compensation types accurately by applying the right calculations for each employee, ensuring a tailored payroll experience for all staff members.

-

How does Payroll Data Entry ensure compliance with tax regulations?Payroll Data Entry ensures compliance by automatically applying the correct tax rates, deductions, and benefits based on the latest regulatory changes. The system can calculate local, state, and federal taxes, ensuring that employees are paid in accordance with tax laws, reducing the risk of penalties due to non-compliance.

-

How does Payroll Data Entry streamline payroll reporting?Payroll Data Entry streamlines payroll reporting by automatically generating reports on employee earnings, tax withholdings, and deductions. These reports are readily available for review and can be easily exported to financial statements or compliance reports, saving time in payroll audits and improving financial transparency.

-

Can Payroll Data Entry handle multiple payroll cycles (e.g., weekly, bi-weekly, monthly)?Yes, Payroll Data Entry can manage multiple payroll cycles, whether employees are paid weekly, bi-weekly, monthly, or on custom schedules. The ERP system automates the payroll process according to the specific payroll cycle, ensuring timely and accurate payments for all employees regardless of their payment frequency.

-

How does Payroll Data Entry save time and reduce errors?Payroll Data Entry in an ERP system automates many manual processes, such as calculating taxes and deductions, and importing time-tracking data. This reduces the risk of human errors like incorrect data entry or miscalculations, saving time and ensuring accuracy in payroll processing.

-

How does Payroll Data Entry ensure data security?Payroll Data Entry in an ERP system ensures data security through encryption, user authentication, and role-based access controls. Sensitive payroll information, such as employee salaries, social security numbers, and tax details, is protected from unauthorized access, ensuring compliance with privacy regulations and safeguarding against data breaches.

-

Can Payroll Data Entry integrate with time-tracking systems?Yes, Payroll Data Entry can integrate seamlessly with time-tracking systems. It automatically imports employee time data, including overtime, vacation hours, and sick leave, into the payroll system, ensuring accurate and consistent payroll calculations based on real-time attendance and worked hours.

-

Can Payroll Data Entry handle complex payroll calculations?Yes, Payroll Data Entry can handle complex payroll calculations such as varying pay rates, shift differentials, bonuses, commissions, and overtime. The ERP system automatically calculates these based on predefined rules, ensuring that payroll is accurate, even for complicated pay structures.

-

What is Payroll Data Entry in an ERP system?Payroll Data Entry in an ERP system refers to the automated process of entering, managing, and calculating payroll data for employees. This includes employee hours, salaries, bonuses, deductions, tax calculations, and other payroll-related information, ensuring accurate and timely payroll processing.

-

How does Payroll Data Entry integrate with accounting and financial systems?Payroll Data Entry integrates with accounting and financial systems, ensuring that payroll data is automatically transferred to the General Ledger, accounts payable, and other financial modules. This seamless integration ensures that all payroll-related expenses are accurately recorded, reducing manual entry and maintaining consistency across the financial system.

-

Can Order Processing integrate with inventory management?Yes, Order Processing can seamlessly integrate with inventory management in an ERP system. This integration ensures that inventory levels are updated in real-time, preventing stockouts and overstocking, while providing accurate order fulfillment and timely delivery to customers.

-

How does Order Processing streamline order fulfillment and shipping?Order Processing streamlines order fulfillment by automatically generating pick lists, packing slips, and shipping labels. It integrates with third-party shipping providers for real-time tracking and cost calculation, enabling faster and more accurate shipping, leading to quicker deliveries and improved customer satisfaction.

-

Can Order Processing handle complex order types?Yes, Order Processing can handle complex order types, including bulk orders, backorders, special requests, and mixed product bundles. It provides flexibility in managing various order configurations, ensuring that all orders, regardless of complexity, are processed efficiently.

-

How does Order Processing improve customer experience?The Order Processing module improves customer experience by providing faster order fulfillment, real-time order tracking, and accurate inventory updates. With automated processes, customers receive timely updates, reducing errors, delays, and order-related issues, thus improving customer satisfaction and loyalty.

-

Can Order Processing integrate with CRM systems?Yes, Order Processing can integrate with Customer Relationship Management (CRM) systems to provide a unified view of customer interactions, order history, and preferences. This integration helps businesses deliver personalized services, track customer behavior, and enhance overall customer relationships, boosting retention and sales.

-

How does Order Processing improve reporting and analytics?The Order Processing module provides real-time reporting and analytics on order status, sales trends, and customer buying behavior. By using these insights, businesses can make informed decisions about inventory, sales forecasting, and resource allocation, improving operational efficiency and profitability.

-

How does Order Processing improve cash flow management?The Order Processing module improves cash flow by automating invoicing and payment reminders, reducing delays in the order-to-cash cycle. It ensures that invoices are sent promptly, and payments are tracked accurately, helping businesses maintain healthy cash flow and financial stability.

-

Can Order Processing track customer payments?Yes, Order Processing can track customer payments, integrating with the Accounts Receivable module to automatically record and reconcile payments. This allows businesses to manage outstanding balances, apply payments to orders, and generate accurate financial reports in real-time.

-

What is Order Processing in an ERP system?Order Processing in an ERP system refers to the automation and management of the entire order lifecycle, from order creation to fulfillment. It integrates customer orders with inventory, shipping, invoicing, and payment systems, ensuring smooth and accurate order fulfillment, improved customer satisfaction, and streamlined operations.

-

How does Order Processing reduce manual errors?Order Processing automates key tasks such as order entry, inventory tracking, and invoicing, significantly reducing the likelihood of manual errors. By eliminating manual data entry and automating workflows, businesses can avoid common mistakes, such as incorrect order details or inventory discrepancies, improving overall accuracy.

-

How does Loan Amortization improve financial forecasting?Loan Amortization provides businesses with a clear view of future loan obligations. By automating repayment schedules, businesses can accurately forecast cash flow, plan for future payments, and make informed financial decisions based on their debt obligations.

-

How does Loan Amortization help manage business debt?The Loan Amortization module helps businesses manage their debt by providing a structured plan for repayments. It ensures timely and accurate payment tracking, helps with forecasting future payments, and maintains compliance with financial agreements, reducing the risk of missed payments and penalties.

-

How does Loan Amortization track interest and principal separately?The Loan Amortization module automatically calculates the interest and principal components of each payment. It tracks the breakdown of each loan installment, allowing businesses to see exactly how much of their payment goes toward reducing the loan balance and how much is paid as interest over time.

-

Can Loan Amortization track balloon payments or lump sum payments?Yes, Loan Amortization can accommodate balloon payments or lump sum payments within the repayment schedule. It adjusts the amortization plan to reflect these changes, ensuring that the loan balance is correctly reduced and future payments are recalculated accordingly.

-

Can Loan Amortization be integrated with other financial modules in the ERP system?Yes, the Loan Amortization module can be seamlessly integrated with other financial modules such as General Ledger, Accounts Payable, and Bank Reconciliation. This integration ensures that loan transactions are recorded accurately, providing a complete financial picture and simplifying reporting and auditing.

-

What is Loan Amortization in an ERP system?Loan amortization in an ERP system refers to the process of calculating and tracking loan repayments over time. It breaks down each payment into principal and interest portions, ensuring that your business can accurately manage and forecast its loan obligations. This module helps automate loan schedules, ensuring accurate payments and financial records.

-

Can Loan Amortization handle multiple loans with different terms?Yes, Loan Amortization in an ERP system can handle multiple loans with varying terms, interest rates, and repayment schedules. This allows businesses to manage different debt obligations simultaneously, ensuring accurate tracking and reporting for each loan.

-

How does Loan Amortization help with tax compliance?The Loan Amortization module ensures that businesses properly account for interest expenses and loan payments. This is crucial for tax compliance, as interest payments may be deductible. Automated tracking helps businesses generate accurate reports that align with tax requirements, reducing the risk of errors during tax season.

-

What are the benefits of automating Loan Amortization?Automating Loan Amortization eliminates manual errors, reduces administrative work, and ensures compliance with loan agreements. It helps businesses stay on top of payments, reduces the risk of late fees, and ensures that the loan balance is accurately tracked across multiple accounting periods.

-

How does Loan Amortization affect my financial reporting?Loan Amortization affects financial reporting by providing accurate, up-to-date information on outstanding loan balances, interest expenses, and payment schedules. It integrates with financial statements, helping businesses present a clear picture of their liabilities and ensuring that reports are accurate and compliant with accounting standards.

-

Can Job Stream track progress and notify teams of delays?Yes, Job Stream offers real-time progress tracking and automated notifications. The system alerts teams of any delays, issues, or changes to the schedule, allowing them to take immediate action and mitigate any negative impact on project timelines.

-

Can Job Stream handle multiple job workflows simultaneously?Yes, Job Stream is designed to handle multiple workflows and jobs simultaneously. This functionality allows businesses to manage several projects or processes at once, ensuring that resources are allocated appropriately and tasks are completed efficiently across all job streams.

-

Can Job Stream integrate with other ERP modules?Yes, Job Stream can integrate seamlessly with other ERP modules like Job Manager, Inventory Management, Accounts Payable, and Payroll. This ensures that all tasks are connected and synchronized across departments, resulting in more accurate, real-time updates and smoother business processes.

-

How does Job Stream improve team collaboration?Job Stream improves collaboration by providing a centralized platform where all team members can access job details, task assignments, and progress reports. It allows employees to share updates, communicate about issues, and collaborate on tasks, which leads to better teamwork and faster problem resolution.

-

What is a Job Stream in an ERP system?A Job Stream module in an ERP system helps businesses automate and streamline workflows across multiple jobs, tasks, or processes. It enables the efficient scheduling and execution of various tasks in a pre-defined sequence, ensuring that each step of a job or project flows smoothly from start to finish.

-

How does Job Stream handle task sequencing?Job Stream allows businesses to define and automate the sequence of tasks or activities required for a project. It ensures that tasks are completed in the correct order, minimizing delays and preventing tasks from being skipped or performed out of sequence.

-

What reporting features does Job Stream offer?Job Stream provides detailed reports on job progress, task completion, resource utilization, and workflow efficiency. These reports help businesses monitor job performance, identify bottlenecks, and make data-driven decisions to improve productivity and profitability.

-

What long-term benefits does Job Stream provide for businesses?Long-term benefits of using Job Stream include increased efficiency, reduced operational errors, faster project completion, and improved resource management. It helps businesses optimize workflows, reduce manual intervention, and increase visibility into job performance, leading to higher profitability and more successful projects.

-

How does Job Stream improve operational efficiency?Job Stream improves operational efficiency by automating repetitive tasks, ensuring tasks are executed in the correct order, and reducing human error. It also provides a central system to track and monitor the progress of jobs, improving coordination and speeding up the completion of projects.

-

How does Job Stream help with job prioritization?Job Stream allows businesses to set priorities for tasks or jobs, ensuring that high-priority projects are completed first. It automates task scheduling and resource allocation based on priority levels, helping teams focus on what matters most and ensuring that important tasks are never delayed.

-

What long-term benefits does the Job Manager module offer?Long-term benefits of using Job Manager include improved project delivery efficiency, better resource management, higher job profitability, enhanced team collaboration, and more accurate forecasting. By streamlining job management and providing clear visibility into job progress, businesses can consistently meet deadlines, reduce costs, and improve overall project outcomes.

-

What is Job Manager Software for Businesses in the USA, and how does it work in an ERP system?Job Manager Software for Businesses in the USA plays a crucial role in an ERP system, helping companies efficiently plan, track, and manage jobs or projects from start to finish. It allows businesses to oversee job details, assign resources, track progress, and ensure that deadlines are met, all from a centralized platform. This software is particularly beneficial for businesses in the USA as it helps streamline operations, improve productivity, and maintain better control over project timelines and resources.

-

Can Job Manager Software handle multiple jobs or projects simultaneously?Yes, the Job Manager Software module can efficiently manage multiple jobs or projects at the same time. It provides a comprehensive view of all active projects, allowing businesses to track progress, allocate resources, and ensure all jobs are progressing according to schedule.

-

How does Job Manager Software integrate with other ERP modules?Job Manager integrates seamlessly with other ERP modules like Accounts Payable, Inventory Management, Job Costing, and Payroll. This integration ensures that all aspects of job management, such as budgeting, resource allocation, invoicing, and payroll, are connected and updated in real-time across the entire system.

-

How does Job Manager help with job scheduling and deadlines?Job Manager helps businesses create detailed job schedules, set deadlines, and track progress in real-time. The module allows managers to assign start and end dates, monitor task completion, and ensure that every aspect of the job is completed on time, reducing the risk of missed deadlines.

-

How does the Job Manager Software module improve project efficiency?The Job Manager Software module improves efficiency by streamlining workflows, providing real-time project tracking, and offering visibility into resource allocation. It ensures that tasks are completed on time, resources are optimized, and project timelines are adhered to, thus reducing delays and improving productivity.

-

What kind of reports can I generate with the Job Manager module?The Job Manager module provides a variety of reports, including Job Progress Reports, Resource Allocation Reports, Task Completion Reports, and Project Performance Dashboards. These reports provide valuable insights into job status, resource utilization, and project timelines, helping businesses make data-driven decisions.

-

Can Job Manager handle job prioritization and rescheduling?Yes, the Job Manager module allows businesses to prioritize jobs based on urgency, resource availability, and business needs. If delays occur, the system can automatically reschedule tasks and allocate resources to ensure that high-priority jobs are completed first without affecting the overall project timeline.

-

How does Job Manager support communication within teams?Job Manager enhances team communication by offering features such as task comments, notifications, and collaboration tools. Team members and managers can easily share updates, ask questions, and provide feedback within the system, ensuring seamless collaboration and faster problem resolution.

-

Can the Job Manager module help with task delegation and resource allocation?Yes, the Job Manager module allows businesses to assign tasks and allocate resources (such as labor, equipment, and materials) directly within the system. It helps managers optimize resource distribution, ensuring that projects are completed on time and within budget.

-

How does the Job Costing Software help improve project profitability?The Job Costing software module enables real-time tracking of all job-related expenses, helping businesses identify cost overruns early. By comparing actual costs to budgeted costs, businesses can make informed decisions to adjust resource allocation, improve efficiency, and ensure projects stay within budget, ultimately improving profitability.

-

What reports can I generate with the Job Costing software?The Job Costing software provides various reports, including Job Profitability Reports, Budget vs. Actual Reports, Labor and Material Cost Breakdown, and Variance Reports. These reports offer deep insights into job performance, helping businesses evaluate costs and make data-driven decisions to improve job efficiency.

-

Can the Job Costing Software track labor and materials costs?Yes, the Job Costing module tracks both labor and material costs associated with each job. It allows businesses to allocate labor hours, material usage, and other expenses directly to specific projects, providing a detailed breakdown of costs and enabling more precise job cost analysis.

-

What is the best Job Costing Software in an ERP system?Job costing software in an ERP system allows businesses to track, manage, and analyze the costs associated with specific jobs or projects. It helps monitor direct and indirect expenses like labor, materials, equipment, and overhead, enabling accurate job profitability analysis and efficient project cost management.

-

How does the Job Costing Software module integrate with other ERP modules?The Job Costing Software module seamlessly integrates with other ERP modules like Inventory Management, Purchasing, Accounts Payable, and Payroll. This integration ensures that costs from materials, vendor invoices, and employee labor are automatically recorded and allocated to the right job, eliminating manual data entry and enhancing accuracy.

-

Why is the Best Construction Job Costing Software for Businesses in the USA essential for project success?The best construction job costing software for businesses in the USA is essential because it provides real-time tracking and management of project costs, helping businesses avoid cost overruns and stay within budget. With features like labor and material tracking, budget forecasting, and detailed reporting, this software ensures that businesses in the USA can efficiently manage their projects, make data-driven decisions, and keep projects on track, ultimately improving profitability and project delivery timelines.

-

How does the Job Costing module help with project budgeting?The Job Costing module enables businesses to set up detailed project budgets, including estimates for labor, materials, equipment, and overhead. It compares actual costs to budgeted amounts in real-time, providing insight into whether the project is on track or if adjustments are needed to avoid cost overruns.

-

How does the Job Costing Software help with job forecasting?The Job Costing software helps with job forecasting by providing historical data on similar projects and allowing businesses to estimate future costs more accurately. This allows for better planning and resource allocation, helping businesses stay on budget and avoid potential cost overruns on upcoming jobs.

-

Can the Job Costing Software handle multiple jobs simultaneously?Yes, the Job Costing software can track and manage costs for multiple jobs or projects simultaneously. It allows businesses to monitor the progress and profitability of all jobs in real-time, ensuring that resources are allocated efficiently across various projects and that no job goes over budget.

-

Can the Job Costing Software track subcontractor costs?Yes, the Job Costing Software can track subcontractor costs. By linking subcontractor invoices and payments directly to the relevant job or project, businesses can maintain accurate records of all subcontractor-related expenses and ensure they are accounted for in job profitability calculations.

-

How does the Inventory Manager module help reduce stockouts and overstocking?The Inventory Manager module uses advanced forecasting tools, automated reorder points, and real-time stock tracking to help businesses predict demand more accurately. By automatically notifying managers when stock levels fall below or exceed predefined thresholds, it prevents stockouts and reduces the risk of overstocking, which can tie up capital and warehouse space.

-

What are the benefits of using barcodes and RFID with the Inventory Manager module?Using barcodes or RFID technology with the Inventory Manager module enhances stock accuracy by enabling real-time scanning and tracking of products. This reduces human error in data entry, speeds up inventory counts, and provides more accurate insights into stock levels, movements, and stocktaking.

-

Does the Inventory Manager module support inventory valuation methods (e.g., FIFO, LIFO, Weighted Average)?Yes, the Inventory Manager module supports multiple inventory valuation methods, including FIFO (First-In-First-Out), LIFO (Last-In-First-Out), and Weighted Average Cost. This flexibility allows businesses to choose the method that best suits their financial reporting needs and industry standards.

-

What long-term benefits can businesses expect from using the Inventory Manager module?Over time, businesses can expect to see significant improvements in inventory turnover, cost savings, and operational efficiency. The Inventory Manager module minimizes stock wastage, reduces storage costs, enhances order fulfillment speed, and improves cash flow by better aligning inventory levels with customer demand.

-